Can you lose 20% of your nest egg and feel good about it?

Posted on July 13, 2018

Unfortunately, the answer is Yes. What? Lose 20% of your nest egg and feel good about it? Well, most investors effectively lose 20% of their nest egg or the biggest portion of their nest egg (stock portfolio) over time and feel good about it. This post describes why that is true and how we avoid doing that in the future. We Nest Eggers don’t want to fall into this trap.

I am on an Investment Committee for a local foundation. We hired Vanguard as Investment Advisor about five years ago. We invest in the Vanguard Funds they recommend: 97% of our total is in Index funds; about 3% is in two Actively Managed bond funds they recommend. We get an excellent comparison report, and all the funds we own perform very close to, if not identical to, their benchmark index. As information for the committee, I recently sent a short memo summarizing the recent SPIVA® report. That report compares the performance of Actively Managed funds to their benchmark index. I included these points:

Actively Managed funds in aggregate returned about 1.2 percentage point less per year than their benchmark index over the last 15 years.

The 1.2 percentage point difference would have compounded over a decade (as an example) to less for an investor – the amount less is about 20% of the initial portfolio. An investor either wins or loses the investing game relative to market returns, and in this case the investor in Actively Managed funds lost (really did not gain) 20% of his or her initial portfolio.

That second paragraph is a slightly different take on what I said here, here, and here. How did I get that 20% loss of the initial nest egg? Why to do most all investors pay no attention to that loss?

========

How did I calculate the loss of about 20% of one’s nest egg over the last decade? I’m comparing the expected return from Actively Managed funds to the expected return from Index funds.

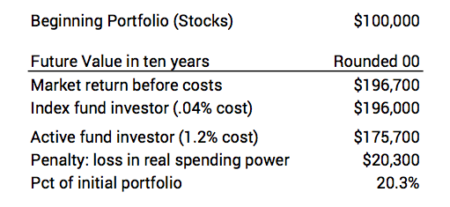

I start with a portfolio value of $100,000 in this example. I’m showing the effect if this was invested in US stocks only. That’s going to be the largest single holding in your portfolio. I use 7% real return. That’s the average annual real return rate for stocks since 1926. (The average real return was 9% over the last decade; that’s an amplifying effect we’ll ignore for now.)

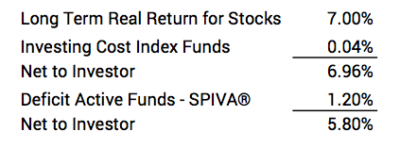

You have two alternative investment approaches. 1) You can invest in a stock Index fund at an investment cost of .04%, meaning you net on average 6.96% per year. 2) You can invest in Actively Managed funds, and, using the SPIVA data, the expected return from these funds will be 1.2 percentage points less than market return rate or 5.8% per year. (Even the Active funds that perform at the 75th percentile underperform their benchmark index by about .5 percentage points per year.) Here are the return rate assumptions.

Now for the future value calculation. Actively Managed funds return roughly $20,000 less in real spending power – about 20% of the original nest egg. You either win or you lose relative to what you easily could have achieved, and Actively Managed funds lost $20,000. (If I used the actual returns over the decade, the loss would be 25% of the original portfolio value; that’s the amplifying effect of greater than average returns.)

========

Why don’t we grasp this? We fail to exert the slow, thinking part of our brain, the part that requires thought and calculations to understand reality.* We miss two measures of reality.

1. We only look at our absolute results and judge we did just great with Actively Managed funds (+$76,000 increase in real spending power). We never compare our results relative to what it should have been (+$96,000).

2. Inflation distorts our view. If I include 1.6% inflation per year (It averaged that over the ten year period ending December 2017.), the future value of Actively Managed funds would have been more than twice as many dollar bills (a $100,000 dollar increase from a $100,000 start). We think we’re REALLY doing great. We lose sight of our results in terms of real spending power, and that has to be our measure of performance.

=========

My friend, Betty, told me that her (prior!) investment advisor told her, “You’ll never notice” when she asked about the high fees she was incurring with him. That’s right. Over the last decade, her portfolio would have increased nicely even with those high fund and advisor fees. But not by nearly as much as it could have. Kudos to Betty: she made the switch to be self-reliant and invest in just a few Index funds: she’ll be WAY AHEAD in the future.

Conclusion: It’s easy to delude ourselves and think we are just doing great by investing in Actively Managed funds in our attempt to outperform the market. But, based on history, the expected result from Actively Managed funds is to lose about 20% of your initial nest egg over a decade relative to what it should be. Don’t do that! Stick with Index funds.

* I liked the book, Thinking. Fast and Slow. Daniel Kahneman.