Don’t throw money away! Use QCD for donations if you are eligible.

Posted on October 19, 2018

I worked through my October tasks for our retirement plan last week. That included a rough picture of what my 2018 tax return might look like. This sunk in: I MUST use Qualified Charitable Distributions (QCD) from our retirement accounts for our donations. I preserve the tax benefit (deductibility from income) if I use QCD. If I don’t, I lose: I’ll pay too much tax; I’m throwing money away. The purpose of this post is to explain why Patti and I must use QCD for donations and why that likely is true for you, too.

Here’s the summary: If you are at least 70½ years old in 2018, you are eligible to use Qualified Charitable Distributions (QCD) for donations from your retirement accounts. Always donate as QCD. The key is that QCD is excluded from the calculation of your Adjusted Gross Income (AGI) that shows on the bottom of the first page of your Form 1040 tax return. Use QCD to lower your AGI on page 1. That means your donations are fully deductible from your income. That’s not always true if you itemize deductions on page 2 on your tax return. Don’t donate from your checkbook assuming you’ll be able to deduct your donations as part of itemized expenses that you’d subtract on page 2 of your tax return.

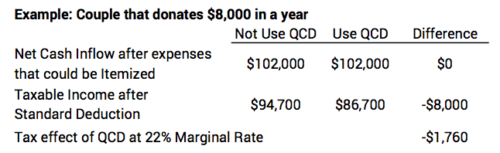

I needed to review the basics and march through an example to fully understand. When we’re finished with the example below, you’ll see that using QCD lowers taxable income by $8,000 (the assumed donations) and results in $1,760 less tax.

========

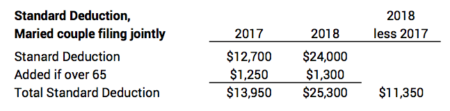

The basics: the new tax law increases the standard deduction to $25,300 for a married couple filing jointly. That’s about $11,400 more than in 2017. If you have less than $25,300 in itemized deductions for 2018, you’re going to take the standard deduction of $25,300. You’re not going to itemize deductions.

We all have three major kinds of expenses that could be deducted from Adjusted Gross Income to get to our Taxable Income. (Tax is calculated on Taxable Income.)

1. Local and State Income and Property Taxes (limited to a maximum itemized expense in 2018 of $10,000)

2. Mortgage Interest (also some new limits that are beyond most all of us)

3. Gifts to Charity – Donations (also a limitation that is beyond most all of us)

For most all of us retirees, those first two definitely will not exceed $25,300, and also for most of us the sum of the three won’t exceed $25,300. We’d take the Standard Deduction. That would mean that none of those three have a beneficial tax effect. Spending is on an after-tax basis.

========

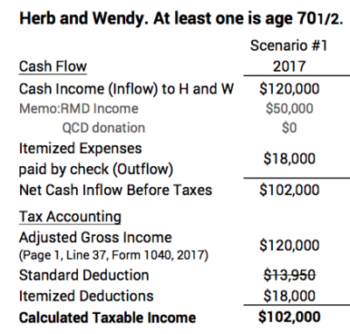

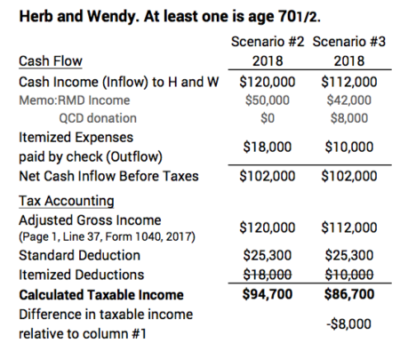

Here’s an example to show the benefit of using QCD. Herb and Wendy are both over 70½ in 2018; they weren’t aware of QCD in 2017. In 2017 they had $120,000 in Adjusted Gross Income. Of this amount, their RMD was $50,000. They had state and local income and property taxes of $6,000; mortgage interest of $4,000; and charitable donations of $8,000 that they wrote out of their checkbook: total of $18,000.

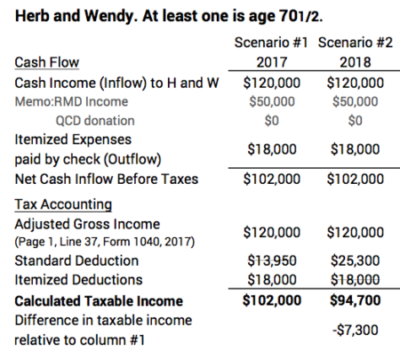

Scenario #1: calculation of 2017 Taxable Income: The amount of money in their pocket after those three expenses but before any taxes was $102,000 ($120,000 in less $18,000 out). In 2017, they would have itemized deductions, because their $18,000 of itemized expenses was in excess of their ~$14,000 standard deduction. Therefore their Taxable Income for 2017 was $102,000 ($120,000 Adjusted Gross Income less the Itemized Deductions of $18,000). Relative to the standard deduction, they received ~$4,000 of added deductions. They could view that a portion of their donations to charities lowered their taxable income and total taxes.

Scenario #2: calculation of 2018 Taxable Income: Let’s just repeat that exact same income and spending scenario for 2018. They have the same $102,000 cash in and cash out before paying taxes. The standard deduction now is $25,300. That’s greater than the $18,000 of expenses they could itemize. Herb and Wendy would take the standard deduction. Taxable income for 2018 is now $94,700 ($120,000 less $25,300). Herb and Wendy have lower taxable income and therefore lower total taxes. They keep more of that $102,000 for themselves. They are correct in viewing that none of their charitable donations had an effect on further lowering their taxes. In essence, all their donations are after-tax gifts.

Scenario #3: repeat 2018 but use QCD. Herb and Wendy use QCD rather than writing the $8,000 from their checkbook. They still have the $102,000 net of cash in and cash out before taxes. The accounting difference is that the QCD is not included in the calculation of Adjusted Gross Income: AGI is now $112,000 ($120,000 less the $8,000 QCD). They still take the $25,300 standard deduction. Taxable Income for 2018 is now $86,700.

Herb and Wendy received the $25,300 Standard Deduction and $8,000 QCD that also lowered Adjusted Gross Income: a total of $33,300 to get to the lower Taxable Income. Relative to Scenario #2, they have $8,000 lower Taxable Income than they otherwise would have for 2018. At a 22% marginal tax rate, this is $1,760 less tax paid.

I lay out the three scenarios side by side here.

========

An added benefit of using QCD is that the calculation of Modified Adjusted Gross Income (MAGI) will be lower. Herb and Wendy could pay greater Medicare premiums if their MAGI exceeds certain income thresholds. The first level of increase in Medicare premiums occurs at $170,000 MAGI for married couples.

========

I’ve found the mechanics to implement QCD are not as simple as writing a check. I have to print a form, fill it out designting charities and amounts, get a Medallion Signature Guarantee (which I’ve not found to be a straightforward task), and get the form to Fidelity. But it is sure worth the effort now.

I like doing this planning at this time of the year in advance of my recalculation date of November 30 and all the tasks that follow in early December. I can plan donations and QCD. Some folks I know use a December 31 calculation date and take their Required Minimum Distribution at the start of the year; I think I’d find that difficult for planning and implementing QCD.

Conclusion: We retirees who are at least 70½ must make our donations directly from our retirement accounts (QCD). Most of us will find that we will take the greater Standard Deduction in 2018 and also receive the full tax benefit (lower tax) from our charitable donations.