A perfect gift idea for your loved ones: start 529 College Savings Plans

Posted on December 1, 2017

This is the time of year that we all think about giving to others we care about. If you’re like Patti and me, you have some left over from your 2017 Safe Spending Amount. Or, if you’ve recalculated for next year (following the CORE), you know that you have a small mountain of money that is More-Than-Enough for your current Safe Spending Amount. You can easily give some of that away and still increase your Safe Spending Amount for 2018. That’s what Alice did.

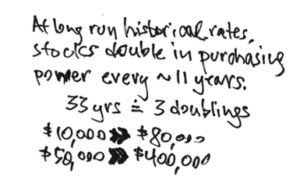

I mention in Nest Egg Care that my friend Chet gave $5,500 to his 22-year old daughter’s ROTH IRA last year. What a great gift. In effect, at age 65, she’ll open the envelope that’s held that $5,500 for 43 years and, at expected rates of return, find it has $80,000 in today’s spending power. Tax free. Wow.

I also like the idea of using a 529 College Savings Plan (or plans) as a way to give to your heirs – your children, grandchildren and even great grandchildren (even if not yet born). I like 529s for a bunch of reasons. Here are the top five for me from the list below: the specific use of your gift may be one you like; your gift is not irrevocable; your gift grows tax free; you have wide flexibility as to who benefits from the plans you start; plans can be very low cost.

I dug to understand 529s better than I had before, but you’ll likely have to dig more. I read the detailed descriptions of 529 College Savings Plans available at both Fidelity and Vanguard and talked on the phone to their representatives; they were extremely helpful. (The plan document from Fidelity was 88 pages long!) I looked at the descriptions of plans at T. RowePrice and Charles Schwab on the web, but I didn’t download and read the details of their plans. I’m sure your brokerage house will have a detailed information package and a representative who can answer your questions. You can also find many sites with excellent information. You can get overwhelmed.

The basics. You open the 529 plan. You are “owner” of the account (529 uses a different legal term, but “owner” fits my brain more easily.) You name a child as the beneficiary for each account. You also name a successor owner on your death for each account.

I like the restriction that means disbursements from this account have to be used for educational expenses. Patti and I like to give gifts that are then used for educational expenses, and clearly a 529 fits that bill. I guess that really means we don’t like gifts that might result in immediate, frivolous spending.

Your gift is not irrevocable. If in the future you find you want or need this money you can withdraw it from the 529 – perhaps you’ll get extremely worried when hit by bad variability of market returns; or you may have large, unforeseen healthcare expenses. You pay a penalty tax on the growth portion, and the growth portion is taxable income (similar to an early withdrawal from an IRA), but you have your money back.

You don’t even have to tell your children about the gift. You can tell them in a few years when you know you’ve dodged bullets of bad variability of stock returns, for example, and are more comfortable about truly giving it away.

The growth and distributions are tax free. The account compounds with no federal taxes and distributions for eligible expenses are not taxed. Eligible expenses are for post-high school education. (They’re what you’d expect: tuition, books and computers, room and board; you’ll find more detail on these eligible expenses.) The hassle, if you want to call it that, is that you (as owner) must keep records to ensure that you spend for eligible expenses.

The right choices for your plan result in really low investing costs. Low investing costs means your investment is compounding at rates very close to what the market is going to give. This is particularly important for plans that might be inter-generational. (See below.) Plans have costs for states (the official trustee of a plan), brokerage house administrative fees, and fund fees (expense ratio). Even with these three, total investing costs are the range of .10% per year at Fidelity (New Hampshire plan) and Vanguard (Nevada plan) if you invest in Index Funds – which is the obvious choice for long-lived plans. Almost too good to be true.

You have flexibility as to who receives the benefit of the 529 plans you open. You are not required to spend the amount in a 529 plan on the beneficiary you initially name. You (or your successor owner) can move money in a 529 plan to others in your family (among plans with the same owner). Let’s assume you open accounts and name each of your five grandchildren as beneficiary. You can move money from the plan of one grandchild to the plan of any other. Family is defined broadly; it’s just not lineal descendants who can benefit.

You can think of your gift as stretching out over two or more generations. I like this potential. That means your gift now can compound for many years. Here’s an example of how this might work. And you can refer to this sketch.

My friends Joe and Judy have two daughters and five grandchildren. They plan to put $50,000 total into five 529 plans that they will open this year – $10,000 in each plan with the grandchild as beneficiary. (This would be their first large gift like this, and they do like the fact that it’s not irrevocable.) Joe will be owner and daughters will be successors. However, Joe and Judy think their two children and spouses will actually pay for all the college education expenses for the five. Perhaps Joe and Judy will help out, but that’s separate from this $50,000 in their mind.

So in that sense, the total may sit there for years before any is tapped for eligible expenses. And it’s easy to shift money from grandchild to great grandchild. As each great-grandchild is born, the owner at the time (Joe or a daughter) will open a new 529 plan and move money into it. So eventually beneficiaries of the initial gift are the great grandchildren (and, of course, their parents who will have to spend less on college expenses).

That $50,000 could be viewed as $400,000. It may be 15 years on average before Joe and Judy’s grandkids marry and have children; it may be another 15 years or so for their children to reach the age when the owner is cutting checks for expenses. In 30 to 35 years, $50,000 compounds to about $400,000 in today’s spending power (constant dollar amount). Wow. A $50,000 gift is terrific. I’d consider a $400,000 gift as a legacy. And of course Joe and Judy and their daughters’ families can add to these accounts in future years.

You may get a state tax deduction for your gift. Patti and I live in Pennsylvania, and a gift to a 529 plan with one of us as owner is tax deductible even if it’s another state’s plan. We save about 3% of our gift in lower PA income taxes. (And we avoid future PA inheritance tax.) Your state may or may not give a tax deduction for one of these really low cost plans like the Fidelity/New Hampshire or Vanguard/Nevada plans. You’ll have to do some homework to figure out what’s best for you; if your plan might be long-lived, you might want a really low cost plan even if that means you forgo the state tax deduction. Here’s an excellent site that describes the deduction for each state.

Alice thought about all this and, in essence, said, “I’ll just give the gift to each of the two 529 plans my son has already set up. I don’t want to be bothered with any decisions as owner down the road. And I’m really giving it; I trust I won’t want it back. In effect, my gift is to him, and he put it in the 529s. He can take the PA state tax deduction.”

Conclusion. We retirees should consider gifts to a 529 College Savings Plan. If you are starting out on your retirement plan, you may not be comfortable about giving away some of your calculated More-Than-Enough. Your gifts to 529 plans you set up are not irrevocable. You can easily move money from the plan of one family member to another. Some or all of your gift might be inter-generational, meaning your gift now has the potential to compound to much more in today’s spending power.