Get this 65% CASH REWARD card!

Posted on July 6, 2018

Probably all of us carry some sort of rewards credit card. We get points, miles, or cash reward on our credit card purchases. We get more to spend at what we perceive to be no cost. (Retailers are passing on their costs for our use of credit cards as higher prices.) This post describes the benefit of the primary credit card that Patti and I use, and it describes a new, SPECIAL CARD I’ve added to my wallet. Relative to most other cards, it’s 30 TIMES BETTER – a 65% cash reward card, in effect. Each of us should have this card!

========

The standard credit card I carry in my wallet earns miles (points) that we can use to purchase airline tickets. This article last Sunday was enough motivation for me to really understand what we earned with our credit card. Does our card match what’s offered today? Boy, there are sure a lot of options: see here and here.

To figure out our reward, I worked through the details of how many total miles we earned last year. For our card, that’s mostly one mile per dollar, but it’s up to 3X on certain purchases. I then figured the value of miles when applied to a ticket. I concluded we earn in dollar value about 2.5% of what we charge on our credit card. I judge that that’s pretty good. We’ll keep what we have.

========

NO CREDIT CARD HOLDS A CANDLE TO THE 65% CASH REWARD CARD THAT IS AVAILABLE TO ALL OF US REIREES. That 65% cash reward is more than 30 times better than the next best direct cash reward credit card I see – 2% on all purchases. (And no one is charging higher prices because we use cards like this one.)

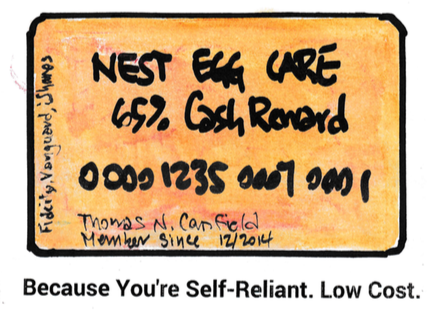

Here’s the card I made, laminated, and now carry in my wallet:

And here is why it is, in effect, 65% CASH REWARD relative to other “cards”. That’s 65% ADDED CASH Patti and I get to spend or gift per year relative to many other retirees.

Here’s the logic of that. (You can read more detail in Chapter 6, Nest Egg Care.) We’ll assume two retirees of the same age in this comparison: Self-Reliant Sam and Typical Retiree Ted.

1. A Retirement Withdrawal Calculator gets us to our Safe Spending Rate (SSR%). Both Sam and Ted have to assume that they will both earn market returns in the future before any Investing Costs. There’s no other logical assumption to make. See here and here.

Sam and Ted are both 70. If you follow the detail in Nest Egg Care (Part 1 and Appendices C and D), you’ll find that 5% is the SSR% for a male, age 70. That 5% rate basically assumes No Investing Cost. We all incur some cost that’s a deduction from market returns, and our decision on that is our Investing Cost.

Let’s also assume the two have $1 million Investment Portfolio. (See Chapter 7.) They therefore each can spend $50,000 at the start of their retirement before consideration of Investing Cost. That $50,000 is their Safe Spending Amount (SSA). It’s is a constant dollar amount that adjusts with inflation each year, similar to the way Social Security payments adjust. (That real $50,000 amount could increase; see Chapter 9.)

2. Each decides how they want to spend the $50,000. First decision: how much do Sam and Ted want to spend in Investing Cost?

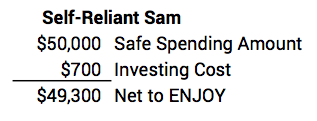

Self-Reliant Sam decides to spend .07% Investing Cost. That’s .07% of his Investment Portfolio; that’s easy to achieve. We can consider that as $700 per year on Investing Cost, and we could think of that as his annual card fee. Sam’s net for other spending to ENJOY is $49,300.

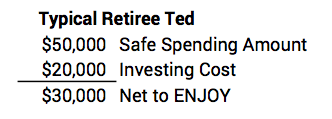

Typical Retiree Ted decides to spend (or fails to decide and unknowingly incurs) 2.0% Investing Cost. This is not unusual: .9% in weighted average mutual fund Expense Ratio and 1.1% in advisor fees. That’s $20,000 per year on Investing Cost. Whoosh. That’s a steep annual card fee. Ted’s net for other spending to ENJOY at the same safety mark as Sam is $30,000.

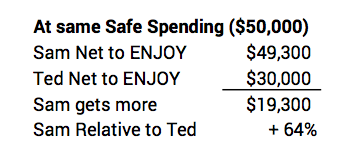

Now the comparison. On the same $50,000 that’s safe to spend, Sam gets to spend or gift $19,300 more per year than Ted. Sam gets a CASH REWARD of an added $19,300 for more spending (and/or gifts) relative to Ted. That’s about 65% boost in spending for Sam relative to Ted.

Think of what Sam could do with the added $19,300! He and his wife could take two, two-week trips to Europe (using those other credit card rewards to help pay for the air tickets). Or, he could gift about $5,000 to 529 College Savings Plans for each of his four grandchildren. Wow!

========

I have coffee now and then with my friend John. We’re about the same age. He’s really smart and successful. But he choses to spend over 20 times what I do in Investing Cost. (He really got to 20 times by failing to explicitly decide.) Every so often, the thought runs through my head: “I’m getting 65% CASH REWARD on the coffee I just purchased. And you’re not.” Or, “We just spent the same on our coffee, but you’re spending is WAY RISKIER than mine.”

John, of course, doesn’t really see that he’s spending about $20,000 that I am not. Or, that his spending puts him at greater risk than me. That’s the beauty, if you want to call it that, of the statements he receives on his portfolio. He never gets a bill or writes a check for his Investing Costs; they’re deducted in non-obvious ways from his portfolio. In a year like 2017, he is happy as hell because his portfolio increased significantly. But the point is (averaging over time) his portfolio will increase by about $20,000 less per year than mine. Over time, that $20,000 per year compounds to a huge difference.

Conclusion. We all like loyalty credit cards that give us more money that we perceive we’re getting for free: Patti and I get miles we apply to airline tickets. The credit card in our pockets gives us an added 2% or so in value. That 2% DOES NOT COMPARE TO 65% CASH REWARD on all spending and gifts we make by being a Self-Reliant retiree. Why do we know that? We know what our Safe Spending Rate is. We know How To Invest: we incur no more than .10% Investing Cost relative to 2% that many others incur.