What are my early October tasks for my retirement plan?

Posted on October 12, 2018

I work on my financial retirement plan two times in the year: early October and early December. I spend time in early October to get a good picture of the tasks for December. That’s my month of heavy lifting. The purpose of this post is to list what I do in early October every year.

I probably spent a total of four to six hours on the tasks. The most time consuming tasks were to think through our actions for gifts and donations and to estimate the appropriate tax withholding percentage on our distributions from our retirement accounts. I did a lousy job estimating my total tax bill last year.

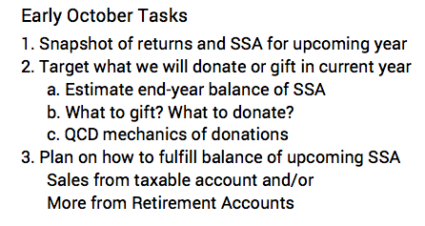

Here is what I do:

1. Get a sense of our Safe Spending Amount (SSA) for 2019. I did this last week. Our SSA for 2019 clearly looks to be the same as for 2018. I’ll only adjust the dollars we pay ourselves for inflation.

2. Decide the amounts we might want to gift or donate to charities before the end of the year and decide how we’re going to do that.

a. Estimate the amount we’ll have left over from our 2018 Safe Spending Amount. Patti and I paid ourselves about 15% more SSA in 2018 than we did in 2017. We did not hold back on travel this year – clearly our greatest discretionary expense – and we have a healthy balance in our checkbook now. More than last year at this time. We have two more monthly payments, and we don’t have any unusual upcoming bills or purchases. I therefore have a good idea of the amount we will have left for gifts + donations.

b. Decide on what to gift and what to donate. Patti and I first decided on gifts. We like gifts to family and heirs as contributions to their retirement accounts and to 529 plans – gifts they’re not likely to spend now and that will almost certainly compound to much more in the future. Our total gifts this year will be similar to last year’s. That means we can plan to donate more to charities we really like (See several we like in Chapter 10, Nest Egg Care.) We like that we’re able to do more of this.

c. Decide on the mechanics of the donations. I’m older than 70½ and Patti turned 70½ in 2018. We must always donate first using Qualified Charitable Distributions (QCD) from our retirement accounts to ensure we obtain the best tax benefits of donating. I’ll describe why in next week’s post. Using QCD adds some added tracking: I’m substituting new QCD for money leftover from this year that we earmarked for donations. That leftover amount is then part of our SSA for next year.

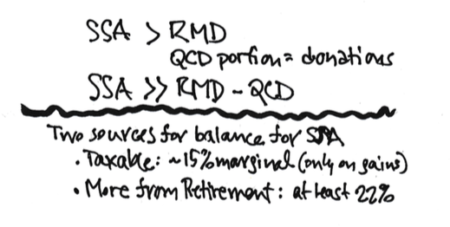

3. Decide how much of the remaining needed for our upcoming SSA will come from taxable accounts and from retirement accounts. SSA is always greater than RMD, so we need to sell more than the RMD amount to get to the total. SSA is the gross amount you can safely withdraw from your portfolio for the year. Spending includes taxes you pay. You want low taxes now to net more to ENJOY now.

I try to get to the balance needed for our total SSA from our taxable account. The 15% tax on the capital gains portion is less than the 22% or more income tax rate on added withdrawals from our retirement accounts. (The obvious exception is withdrawals from a Roth IRA account. Patti and I have no Roth IRA accounts. If you do, you already paid income tax when you invested into your Roth IRA. You don’t pay tax again when you withdraw. To net the most to ENJOY now, you would withdraw first from Roth IRAs.)

When I sell taxable securities, I first sell the shares with highest cost basis and therefore lowest capital gains. My account is at Fidelity, and a tool there arranges all my holdings by highest cost basis to lowest. I then sell the specific, high cost shares. Fidelity tracks the effect of doing that. I’m guessing your brokerage account has a very similar tool.

========

I’ve worked through these steps several years now and see that we spend more from our taxable securities than from our retirement holdings to fulfill our SSA for the upcoming year. That will continue: selling from our taxable account will always result in lower current tax than from taking a greater withdrawal from retirement accounts. At some point in time, Patti and I will essentially deplete our taxable holdings. Our portfolio will almost solely be in retirement accounts. At that time our SSA can only be filled by much greater withdrawals from our IRA accounts than we are taking now. In summary, we’re deferring high marginal taxes on added IRA withdrawals now, but that tactic will play itself out and eventually we’ll pay the piper. (In our much older years – when our appetite for travel is less – perhaps we will withdraw less than our calculated SSA.)

Conclusion: You have just two times during the year that you need to spend any time on your financial retirement plan. You could actually just make it one time, just after your calculation date. I like to get a preliminary picture in early October of what I will be doing in the first week of December. That basically means I want a temperature reading on returns so far in the year to get a sense of what will be happening to our SSA for the upcoming year. I also want to get a good estimate of how much of our 2018 SSA will be left over – the amount we can gift or donate. Patti and I decide on the details of gifts and donations now.